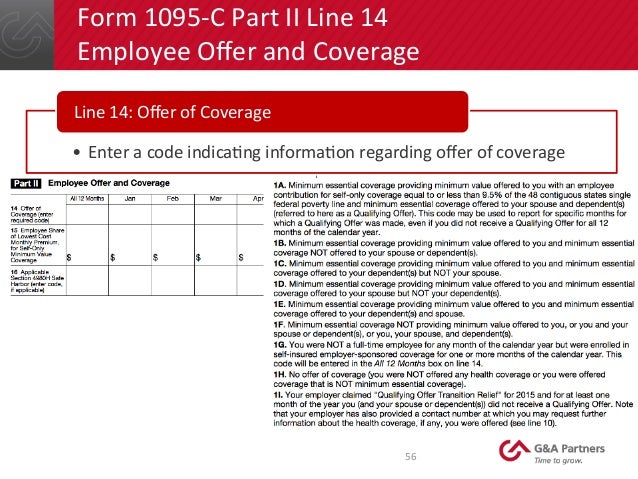

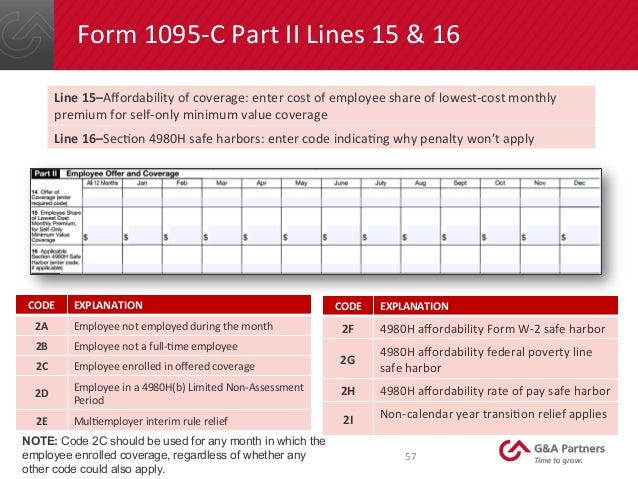

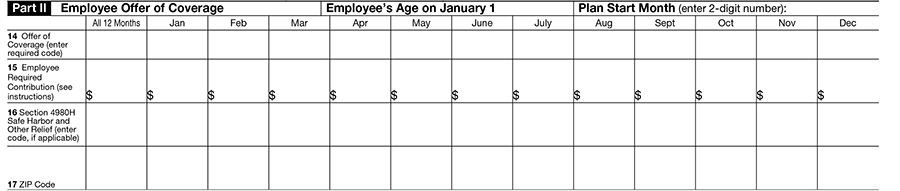

Consequently, on , the IRS released a draft of Form 1095C, which adds new codes (1L 1S) for employers to indicate the method they used to determine affordability for their ICHRA plan These codes are reproduced here 1L Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by usingCODES FOR IRS FORM 1095C 2F Section 4980H affordability Form W2 safe harbor Enter code 2F if the employer used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year If an ALE Member uses thisForm 1095C Line 14–Code Series 1 A Series 1 code must be entered in line 14 to indicate the type of coverage offered (or no coverage offered) to the employee and family Enter a code for each month, or enter one code in the "all 12 months" box if the same code applies for the entire calendar year "Spouse" means the employee's spouse

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

What are the codes for 1095-c

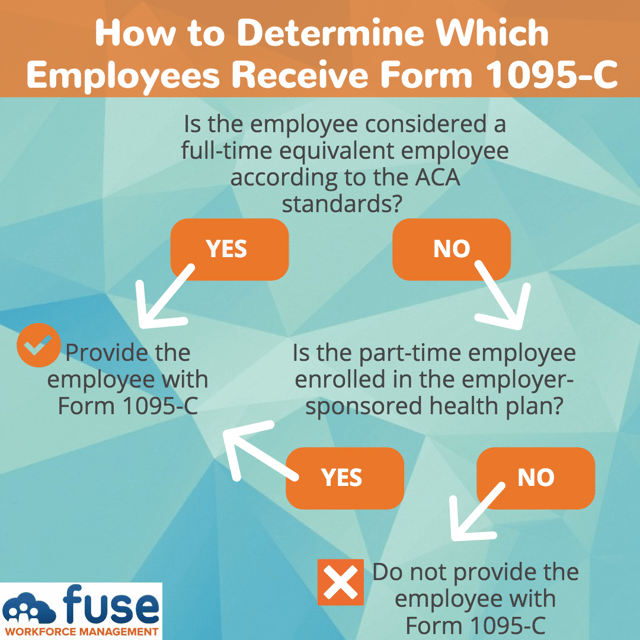

What are the codes for 1095-c- When the 1095C must go out Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for would be sent in January 21 The IRS released its draft IRS Forms 1094C and 1095C, dated as draft as of There are no changes to the Form 1094C from the prior year However, there are some significant changes to the 1095C Of course, depending on how these changes impact your reporting on 1095C, your reporting on the 1094C may also change

Guide To Correcting Aca Reporting Mistakes Onedigital

1095c codes cheat sheet 18;Affordable Care Act 1095C code cheatsheet This information is not tax or legal advice Employers are encouraged to read the instructions and forms in their entirety and work with trusted advisers to prepare any IRS documentsReporting of ICHRA in Line 14 Codes of Form 1095C for In the month of November , the IRS released a revised version of Form 1095C, which adds new codes from 1L to 1S for employers to indicate the method used to determine their ICHRA plan's affordability Click here to learn more about ICHRA The codes are mentioned here

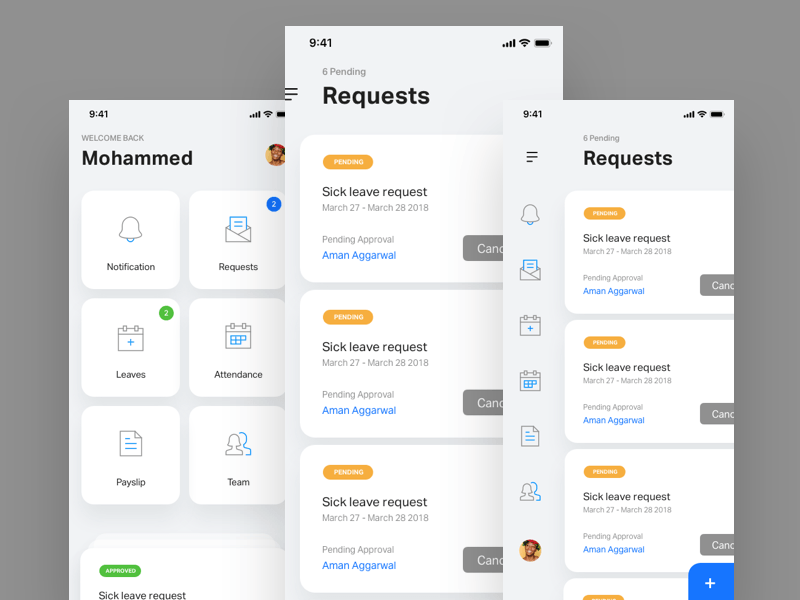

ACA Reporting Service Has Everything You Need To Complete Forms 1094 & 1095 This Is Your Process For Success Seasoned Account Managers (who are great at) guiding you in a full service experience (if that's what you want) through simple steps (in our ACA software) to create Forms 1094 & 1095 (fully coded PDFs, oh yeah!) and submit them (we eDownload our ACA Codes Cheat Sheet View our ACA Codes Cheat Sheet that includes 8 new reporting codes added to the 1095CCode Series 2 for Form 1095C, Line 16 Line 16 of IRS Form 1095C lists a code that describes, for each month in the previous year, the kind of coverage that an employee enrolled in, and how the employer meets the employer shared responsibility "Safe Harbor" provisions of Section 4980H Below is a description of the various codes in Code Series 2

To correctly determine their 1095C Part II codes Some even simply mark all fulltime employees 1A in Line 14 and 2C in Line 16 with no premium amount required to be listed Form 1095C Part II Employee Offer of Coverage Part II of the IRS Form 1095C includes three parts Lines 14, 15 & 16 These lines together paint a pictureHowever, no penalty will be imposed for failure to furnish a correct payee statement to an individual enrolled in an ALE Member's selfinsured health plan if (1) the individual is not a fulltime employee for any month of ; Coding Form 1095C, Part II for MidMonth Hires, ReHires and Terminations Affordable Care Act's Reporting Requirements for Carriers and Employers (Part 14 of 24) Friday,

Team Kcl Uk Contribution Igem Org

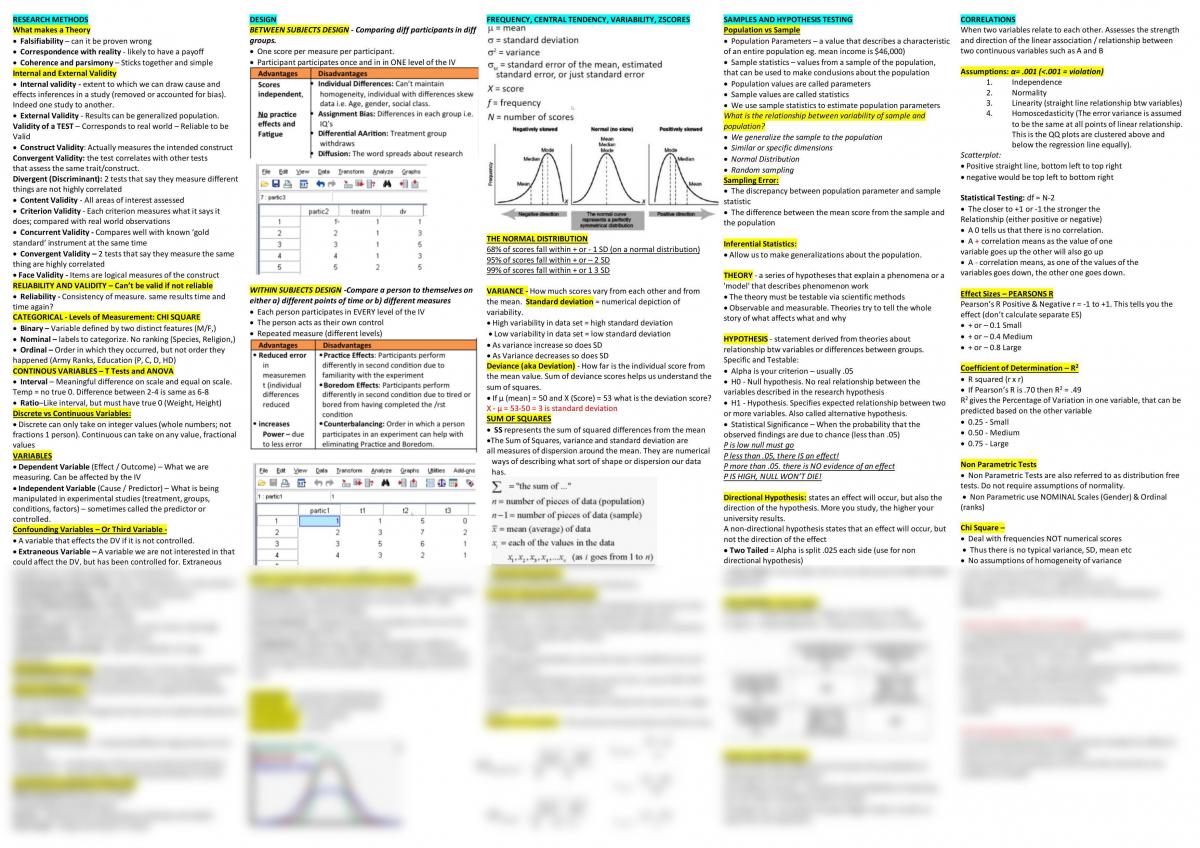

Psyc2 Exam Cheat Sheet Psyc2 Research Methods And Statistics Une Thinkswap

Reporting of ICHRA in Line 14 Codes of Form 1095C for On , the IRS released a Form 1095C draft, which adds new 1095C codes from 1L to 1S for employers to indicate the method used to determine their ICHRA plan's affordability Click here to learn more about ICHRA The codes are mentioned here1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainland single federal poverty line and at least minimum essential coverage offered to spouse and dependent(s)Form 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainland

The Complete Aca Reporting Codes Cheat Sheet Blog Acawise Aca Reporting Solution

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Review the available codes and definitions for Lines 14 and 16 of Form 1095C• Form 1095C Code Cheat Sheet • Form Instructions (Page 11) Consider grouping employees by code "profile" and starting with the easiest ones first • For example, all employees who were full time all year, offered coverage and enrolled in coverage ACA Form 1095 C CodeSheet for Line 14 and Line 16 Updated on 1030am by, TaxBandits Choosing codes to report on lines 14, 15, and 16 of 1095 C might be a tedious process for anyone But, when you look closely, it is pretty much simpleIn this eBook, you'll find a breakdown of Code Series 1 and Code Series 2, as well as an infographic that breaks down Form 1095C line by line , if the employee was offered an ICHRA 5 All 12 months You can use 1095C Cheat Sheet

Form 1095 C Instructions For Employers Furnishing Filing

Irs Form 1095 C Codes Explained Integrity Data

Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to doWebsite's listing c code cheat sheet August 21 Best Travel Voucher Dmv Cheat Sheet Promo Code Newnest 21 77% off (5 days ago) Coupon For Dmv Cheat Sheet 07/21 77% off (6 days ago) Coupon For Dmv Cheat Sheet Overview Coupon For Dmv Cheat Sheet can offer you many choices to save money thanks to 24 active resultsRockville Our Rockville office, formerly known as Early, Cassidy, & Schilling (EC&S), offers a full suite of insurance products and services including commercial insurance, risk management and loss control services, surety bonds, employee benefits and executive benefits Our highly trained professionals work with our clients to identify and

Irs Form 1095 C Codes Explained Integrity Data

Irs Form 1095 C Codes Explained Integrity Data

To do this your business will need to use Code Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will review the codes used and make sure you are compliant with your ACA employer requirements Here is the complete ACA reporting codes cheat sheet The Complete ACA Reporting Codes Cheat SheetForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more Robert Sheen Affordable Care Act 3 minute read Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

The Aca S 1095 C Codes For The Tax Year The Aca Times

(2) the ALE Member posts a notice prominently on its website that individuals may receive a copy of their Form 1095C upon request;IRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland single Below, MP's HR services team provides a refresher on the important evergreen codes for ACA filing and a list of the new ones ACA Reporting Cheat Sheet Form 1095C Line 14 Codes Note that codes 1A, 1E, and 1H are the most commonly used 1A Qualifying Offer You offered a plan that was minimum essential coverage (MEC) and minimum value (MV) to the

F Hubspotusercontent00 Net Hubfs 1095 C cheat sheet Employers Pdf

Aca Code Cheatsheet

All applicable large employers (ALE) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095B Generally, only employers that are nonALEs with a selfinsured plan will complete Forms 1094B and 1095BSeries 2 Indicator Codes 1095C Employee Statement Line 16 Code/Line 16 What it means 2A Employee not employed during the month Enter code 2A if the employee was not employed on any day of the calendar month Do not use code 2A for a month wherein the individual was an employee of the employer on any day of the calendar monthCode Series 1 is used for Line 14 of Form 1095C and addresses • Whether an individual was offered coverage • What type of coverage was offered • Which months that coverage was offered Code Series 2 is used for Line 16 of Form 1095C and addresses • Whether the individual was employed and, if so, whether he or she was full time or

Pandas Numpy Python Cheatsheet With Meme Kaggle

Preparing For The Affordable Care Act In 16

TOP Forms to Compete and Sign; Each code indicates a different scenario regarding an offer of coverage, or explains why an employer should not be subject to a penalty for an employee, for each month ACA 1095 codes cheat sheet Form 1095C Line 14 Code Series 1 Code Series 1 is used for Line 14 of Form 1095C and addresses Whether an individual was offered coverageA GENERAL AGENCY THAT DOES IT ALL, INCLUDING MOBILE TOOLS THAT LET YOU TAKE YOUR OFFICE ANYWHERE With 35 years of insurance sales and back office support experience, we're dedicated to serving brokers Be ready with Word & Brown

Preparing For The Affordable Care Act In 16

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

On the IRS finally released its draft instructions for the Forms 1094C and 1095C While we knew substantial changes were coming to the instructions as a result of Individual Coverage HRAs (ICHRAs), the IRS also made changes that will impact every employer required to file the Forms As a result of most employers not offering ICHRAs and for simplicity Know your ABCs Forms 1095A, 1095B, & 1095C We are authorized to transmit 1094/1095 B and C series forms for private businesses, government entities, and insurance companies ACA Compliance, ACA Forms,Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance

Form 1095 C Instructions For Employers Furnishing Filing

Aca Compliance Reporting Forms 1095 B C Reporting

1095 C Code Cheat Sheet Coupons, Promo Codes 0721 Sale For Today Only at wwwcouponuptocom ACA Codes Cheat Sheet JANUARY 19 PAGE 2 Line 16 of Form 1095C or Code Series 2 o Addresses whether the individual was employed during the month and, if so, whether he or she was full time or part time o States whether the employee was enrolled in1095C Code "Cheat Sheet Line 16 codes ;1095c codes cheat sheet 21 Get Form form1095ccom is not affiliated with IRS form1095ccom is not affiliated with IRS Home;

Hr Affordable Care Act Compliance Platform

Aca Code Cheatsheet Release Notes

Avionte Logic for Populating 1095C Report Line Code Logic 14 1A1S Employee is ACA Full Time, either set to Yes by a user, or measured as full time employee based on the ACA hours paid An offer of coverage touches the employee's record for the full calendar month (in the ACA Companion > Employee Plan Details) These codes are selected inWebsite's listing c cheat sheet pdf August 21 25% Off Cheat Sheet getcouponcodesinfo 25% Off Cheat Sheet Getcouponcodesinfo 25% Off 6 hours ago 25% Off Cheat Sheet Getcouponcodesinfo 25% Off 6 hours ago 25% Off 8 hours ago Use this page as a cheat sheet during your TFT Hyper Roll game to help make the most optimal item decisions, or before the Changes Coming for Form 1095C On , the Internal Revenue Service (IRS) provided a draft that shows changes to the tax forms for Rest assured Tango is reviewing and preparing to comply with the changes The 1094C form that gets transmitted to the IRS and shows the overall compliance for an EIN remains the same

Toast Payroll Common Combinations Form 1095 C Codes

Irs Announces Additional Ichra Codes For Form 1095 C

The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information

F Hubspotusercontent00 Net Hubfs 1095 C cheat sheet Employers Pdf

Http Www Lockton Com Resource Pageresource Mkt Compliance Lines 14 And 16 Cheat Sheets Cr Pdf

Guide To Correcting Aca Reporting Mistakes Onedigital

Aca Code Cheatsheet

F Hubspotusercontent00 Net Hubfs 1095 C cheat sheet Employers Pdf

Aca Code Cheatsheet

Www Wordandbrown Com Getmedia 6a661f05 A35b 4f67 934e B0585cedfed2 Aca Ref Irscodes Sj 007 Pdf

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Code Series 2 For Form 1095 C Line 16

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Payroll Systems Your Payroll Cheat Sheet Payroll Systems

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Aca Compliance Knowledge Base Integrity Data

Www Unifyhr Com Wp Content Uploads 18 09 Unifyhr Insiders Guide To Form 1095 Pdf

Aca Code Cheatsheet

Aca Code Cheatsheet

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Police Codes Police 10 Codes All Police Codes Explained

Eikon Data Api Cheat Sheet Refinitiv Developers

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

What Is Form 1095 C Filing Methods Due Dates Mailing Address

1

Irs Form 1095 C Codes Explained Integrity Data

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Aca Reporting Service Form 1095 B C E Filing Solution

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Irs Form 1095 C Codes Explained Integrity Data

Eikon Data Api Cheat Sheet Refinitiv Developers

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Common 1095 C Scenarios

Aca 1095 C Code Cheatsheet

Irs Form 1095 C Codes Explained Integrity Data

F Hubspotusercontent00 Net Hubfs 1095 C cheat sheet Employers Pdf

The New 1095 C Codes For Explained

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

21 Aca Code Cheatsheet Download Our Free Guide

1

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Compliance Hrms Human Capital Management Bizmerlinhr

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Compliance And Reporting Software Employers Consultants

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

The Codes On Form 1095 C Explained The Aca Times

Www Ergpayroll Com Aca Compliance How To Complete Form 1095 C And Form 1094 C

New 1095 C Codes For Tax Year The Aca Times

1

Aca Code Cheatsheet

Form 1095 C Instructions For Employers Furnishing Filing

The New 1095 C Codes For Explained

F Hubspotusercontent00 Net Hubfs 1095 C cheat sheet Employers Pdf

1

Eikon Data Api Cheat Sheet Refinitiv Developers

9 Google Sheets Formulas Cheat Sheet Coding Is For Losers

Irs Form 1095 C Codes Explained Integrity Data

Form 1095 C Guide For Employees Contact Us

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

9 Google Sheets Formulas Cheat Sheet Coding Is For Losers

Common 1095 C Scenarios

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

Aca Code Cheatsheet

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Aca Code Cheatsheet

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Code Cheatsheet Release Notes

0 件のコメント:

コメントを投稿