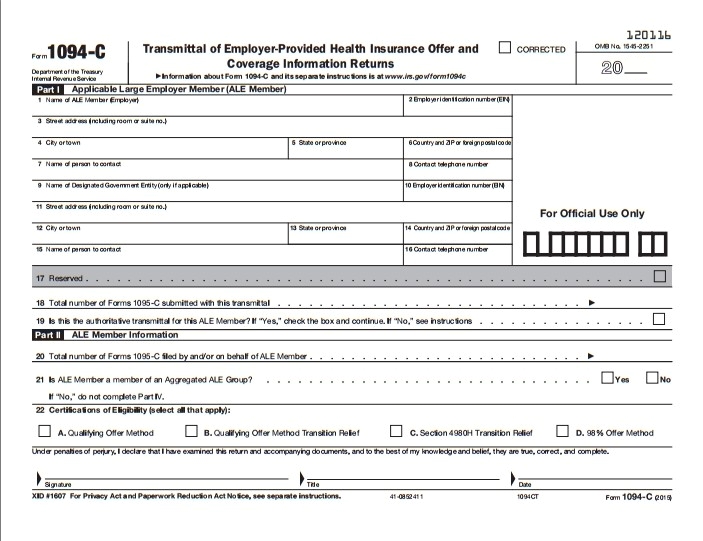

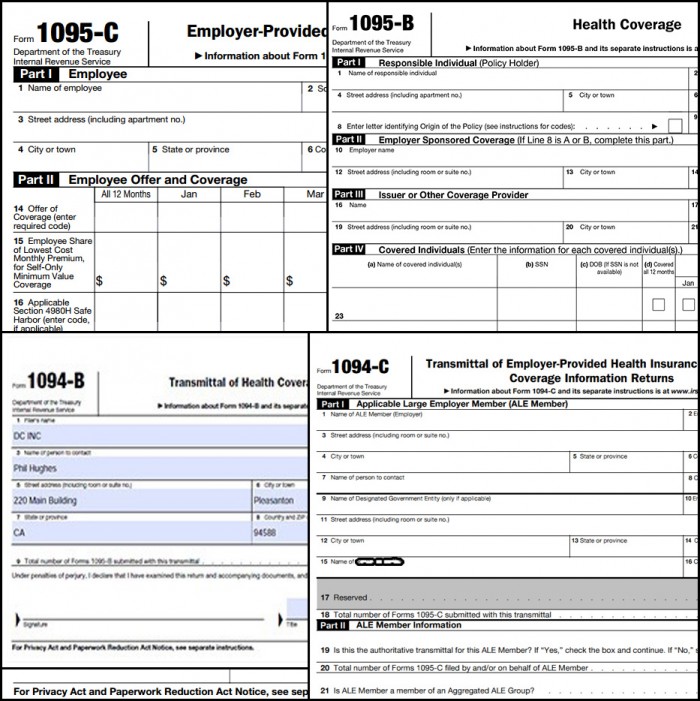

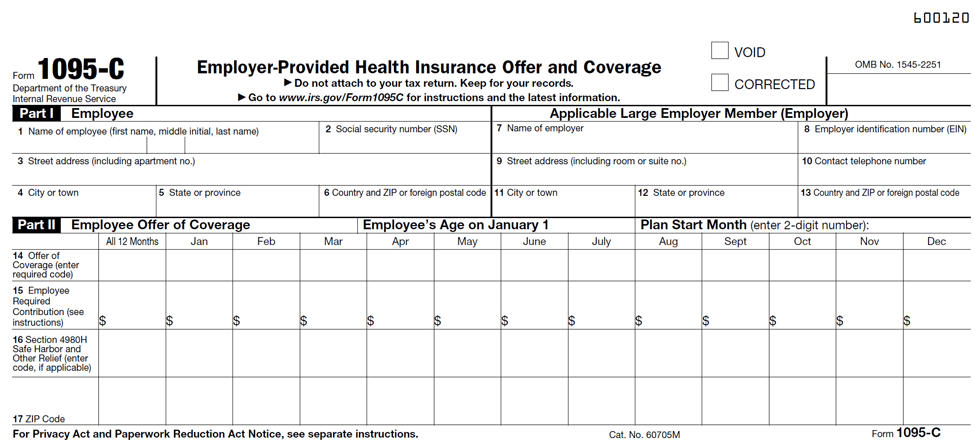

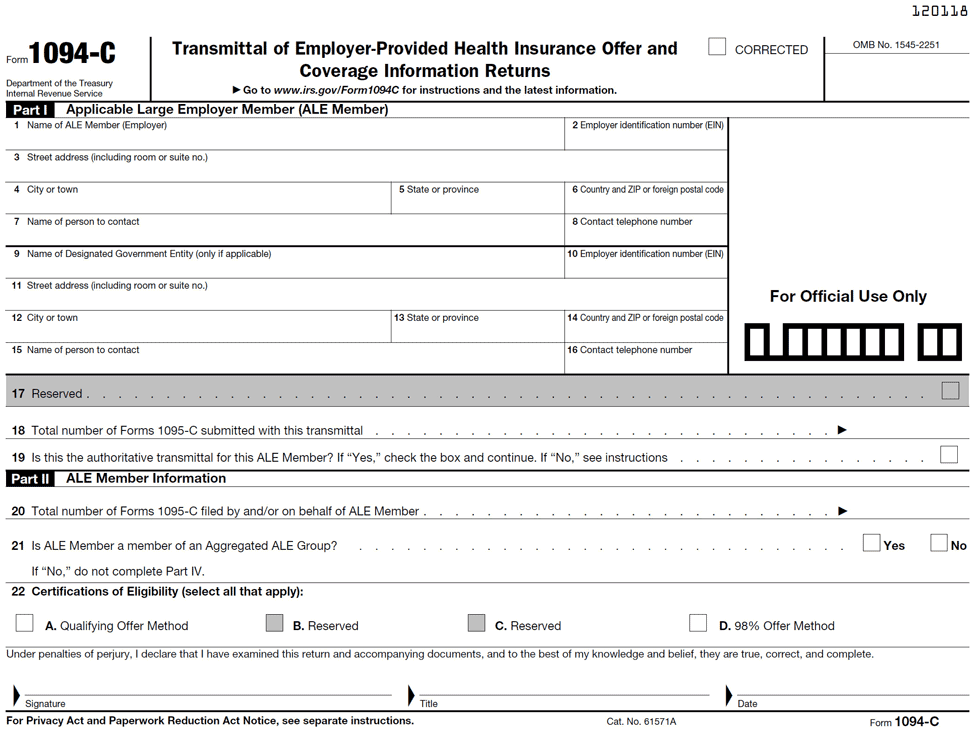

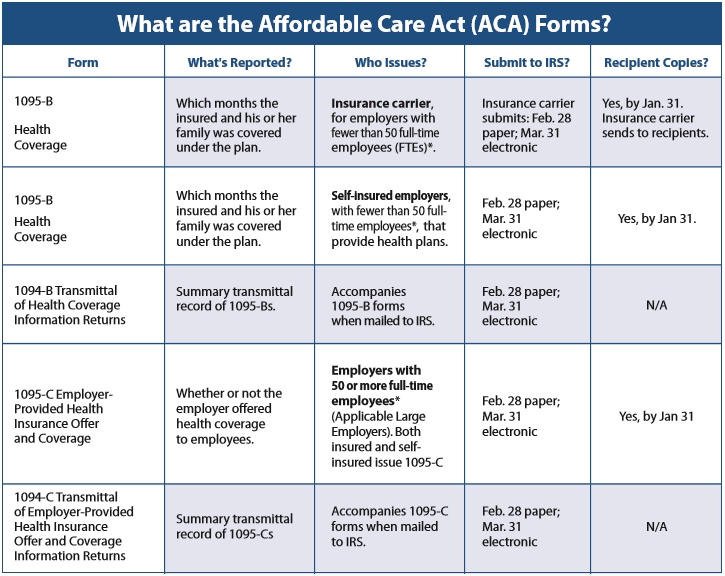

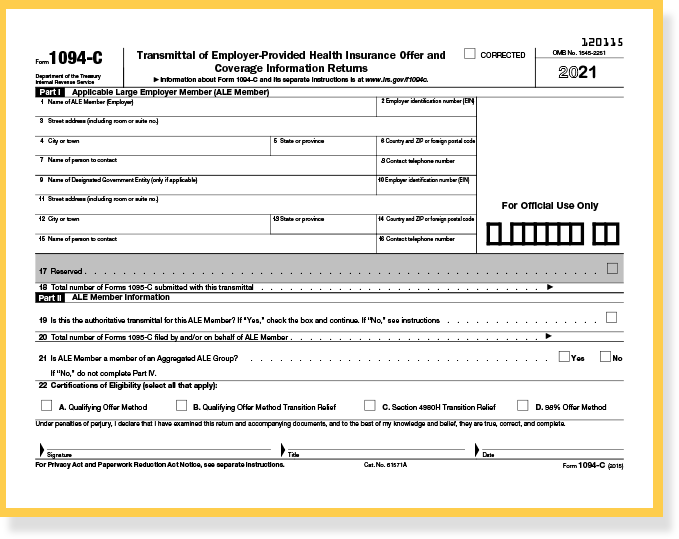

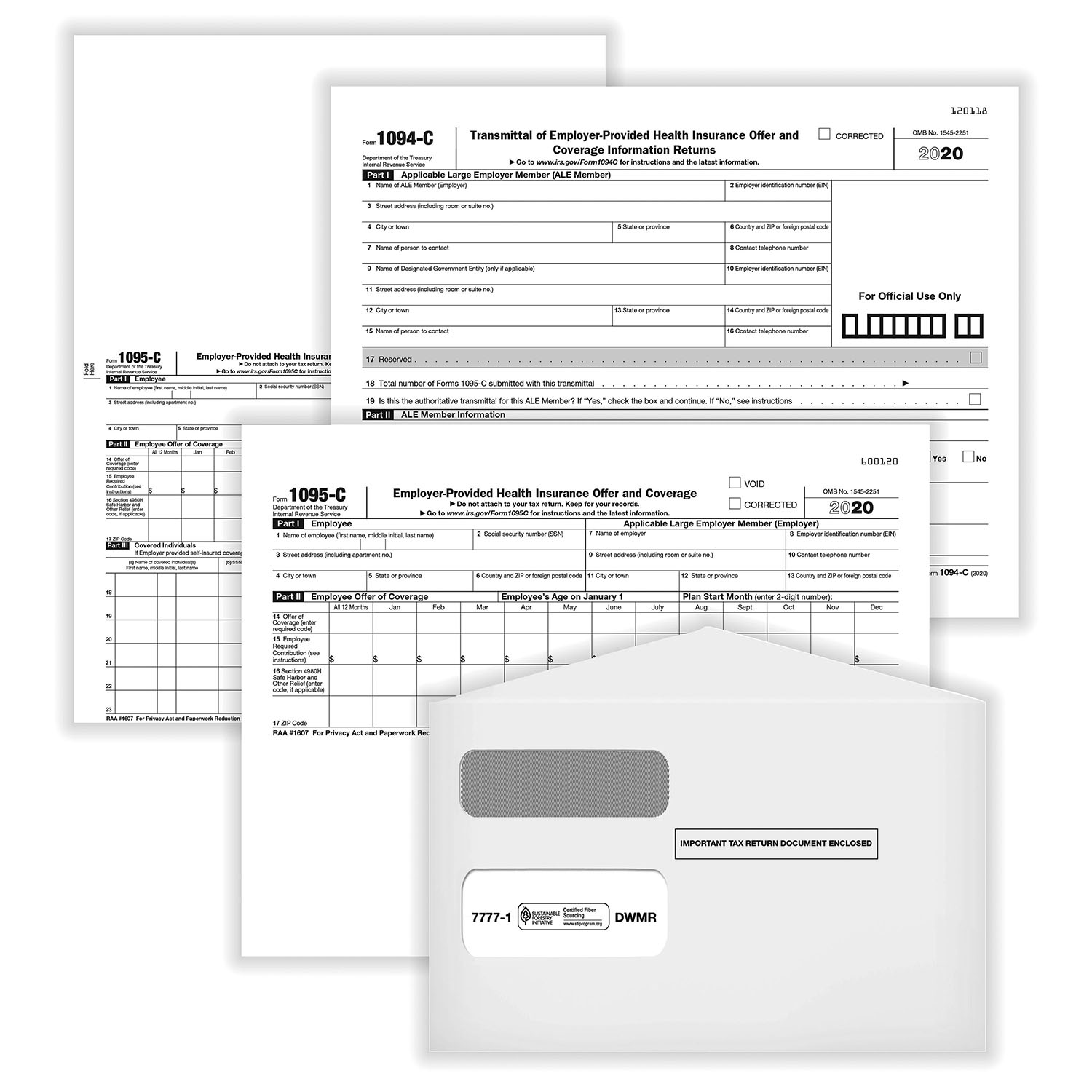

The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095CPurpose of Form Employers with 50 or more fulltime employees (including fulltime equivalent employees) in the previous year use Forms 1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees

Irs Provides Aca Reporting Relief For Compliance Guidance

1094 c and 1095 c

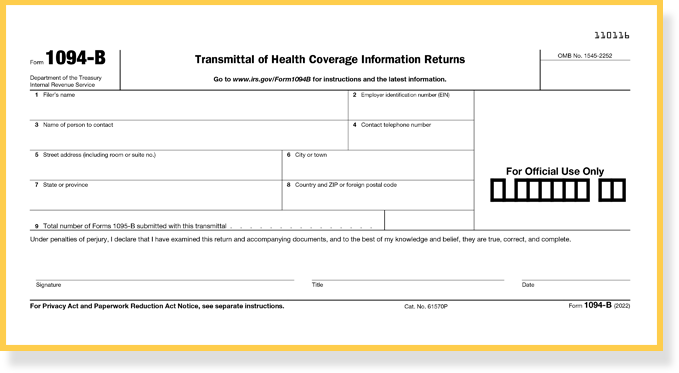

1094 c and 1095 c- Form 1094C summarizes the ALE's 1095C information returns as well as details pertaining to the organization, such as EIN, address, point of contact, and certifications of eligibility regarding the health insurance offered for a particular year Specifically, Form 1094C Form 1095C is the information return used to report information about each employee while Form 1094C is the transmittal summary The employer is required to file Forms 1094C and 1095C with the IRS and to furnish a copy of Form 1095C to the employee Import

Accurate 1095 C Forms Reporting A Primer Integrity Data

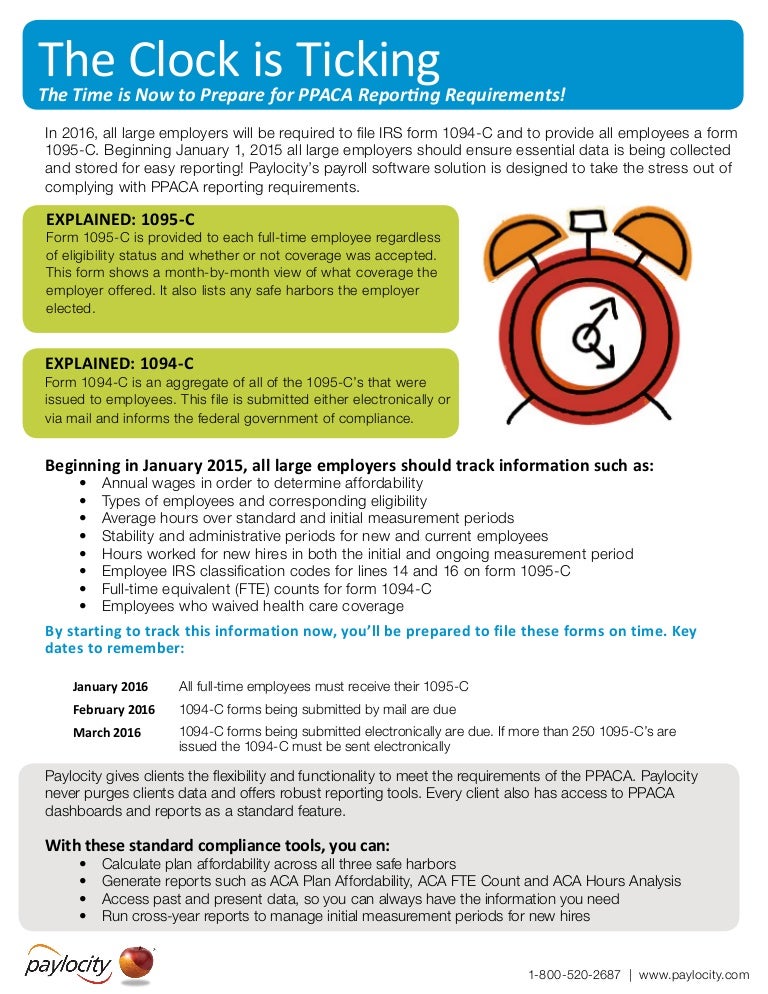

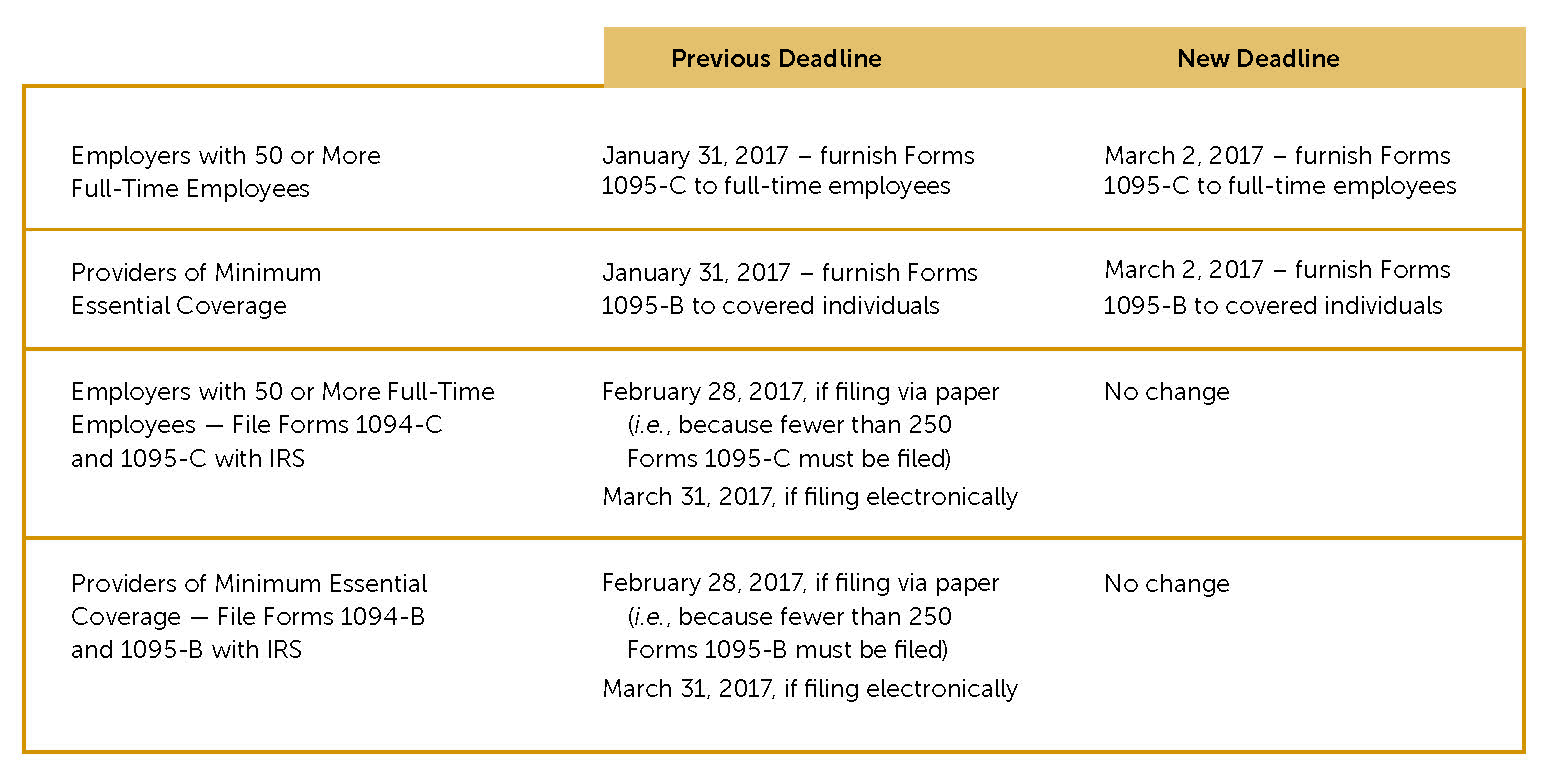

The deadline to send forms 1095C and 1094C to the IRS on paper is , when filing electronically the due date is All data needed to fill 1095C / 1094C forms can be saved for later use and modification (forms stored for future access and corrections) Mailing Instructions for Filing Paper Forms 1094C and 1095c Here are some general tips for employers who wish to file their Forms 1094C and 1095C by mail Do not paperclip or staple the forms together Check for the correct IRS address Postal regulations require all forms and packages to be sent by FirstClass Mail1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C also is used in determining the eligibility of employees for the premium tax credit

Form 1094C and Form 1095C are forms used to report required information about healthcare to the IRS Following the Affordable Care Act (ACA), all applicable large employers (ALEs) need to report whether they've offered health coverage to each employee and whether those employees are enrolled in health coverageA Form 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a Form 1095C for each employee who was a fulltime employee of the ALE Member for any month of the calendar year Generally, the ALE Member is required to furnish a copy of the Form 1095C (or a substitute form) to the employee Form 1094C is a transmittal to the IRS that, in combination with Form 1095C providing individualized information, satisfies these requirements Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file

The 1094C/1095C Batch Worksheet is saved in the same location as your 1095C internet file when it is processed The worksheet, which contains the Batch ID, Submission ID, and a list of the employees that are included in the file, including their Record ID, makes it easier to file any corrected 1094C/1095C forms laterApplicable Large Employers (ALE) are still required to report coverage for the year Form 1095C and Form 1095B statements must be provided to fulltime employees by The due date for electronically filing Forms 1094/1095B and 1094/1095c1095C submissions and corrected IRS Form 1095C submissions – they need to be transmitted separately Our application allows you to select between Original and Corrected •It is possible to submit a corrected IRS Form 1094C without any corresponding IRS Form 1095C–for example •Total employee count was wrong for a month

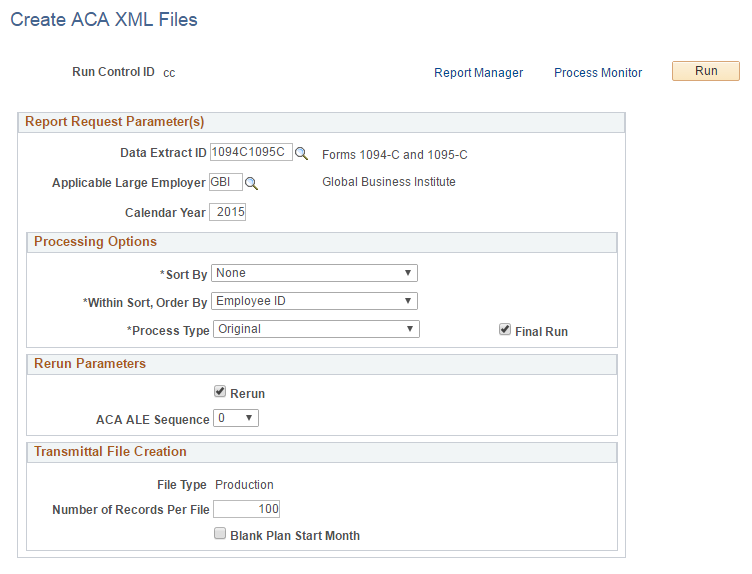

Affordable Care Act Electronic Filing Instructions

Supporting Affordable Care Act Aca 1094 C And 1095 C Prismhr

Usually, you need to file Types 1094C and 1095C by February 28 if submitting on paper (or March 31 if submitting electronically) of the yr following the calendar yr to which the return relates For calendar yr , Types 1094C and 1095C are required to be filed by , or , if submitting electronicallyForm 1094C If you are required to file electronically (if you are filing at least 250 Forms 1095C along with your Form 1094) make sure your vendor is prepared If selffiling electronically, start the process to prepare long before the forms are due • Get started with electronic selffiling hereForm 1094C is the transmittal form that must be filed with the Form 1095C This form is the transmittal form that must be filed with the Form 1095C Current Revision Form 1094C About Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Internal Revenue Service

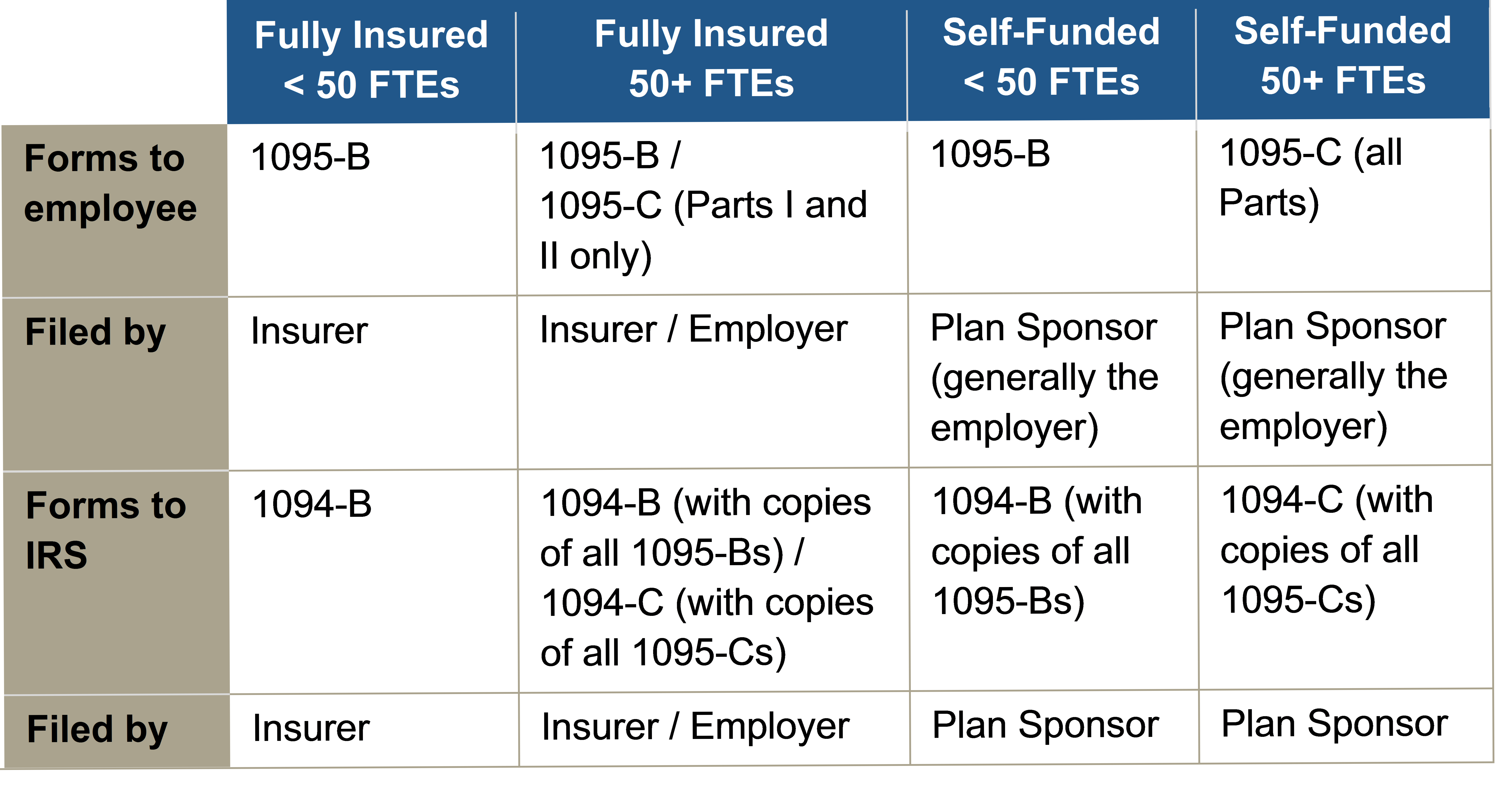

Aca Compliance Reporting Morris Reynolds Insurance

1094 C Form Transmittal Discount Tax Forms

Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay requirementFailure in completing any or both of Forms 1094C and 1095CThe 1094C can be thought of as a cover sheet for all of an organization's 1095Cs It isn't distributed to employees and requires information such as the number of people employed and how many 1095C forms are being filed Employers need to know that they must file one Form 1094C per tax ID (or EIN) to the IRS

Alert Irs Extends Due Date For Forms 1095 C And 1095 B

1095 Software Aca Software 1095 Reporting

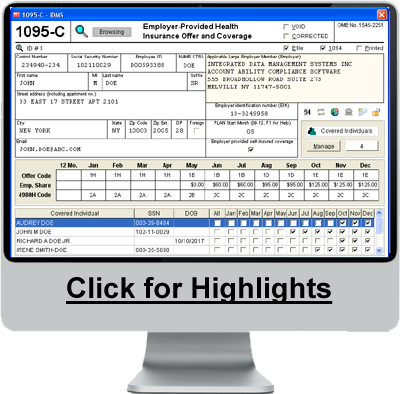

How do I electronically file Forms 1094C and 1095C with the Internal Revenue Service (IRS)?Directions for filing can be found at the IRS website US Office of Personnel Management1095C User Interface The ACA Addon for Account Ability ( try it now) supports ACA Forms 1095C and 1094C 1095B (IRS 6055) Compliance The ACA Addon also includes support for ACA Forms 1095B and 1094B ALEs can furnish the employee with a copy of the Form 1095C filed with the IRS or with an approved substitute form, which Account

3

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

For California purposes, federal Forms 1094C and 1095C must be filed by March 31 of the year following the calendar year to which the return relates Federal Form 1095C must be provided to the employee and any individual receiving MEC through an employer by January 31 of the year following the calendar year to which the return relatesThe Manifest file and the data file will be generated for correction transmission of 1095C If both 1094C and 1095C have corrections, complete the following steps Generate 1094C correction files by selecting 1094C in the Type of Data Correction field Generate 1095C correction files by selecting 1095C in the Type of Data Correction field Forms 1094C and 1095C are required to be completed all employers with 50 or more full time equivalent employees This must be filed by any employer subject to the employer mandate Form 1094C is the Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns

Www Irs Gov Pub Irs Prior Ic 14 Pdf

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Form 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employeesInst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Form 1094C Transmittal of EmployerProvided Health Insurance Offer and At Form 1094C, Part II, Line 22 and Part III, column (e), ALE's mostly failure to indicate transitional relief Selfinsured plan failure in reporting taxpayer identification numbers of all covered individuals ALE's may fail to file and furnish ACA reporting forms on time ;

Setting Up And Managing Correction Replacement Of Forms 1094 C And 1095 C

Ez1095 Software How To Print Form 1095 C And 1094 C

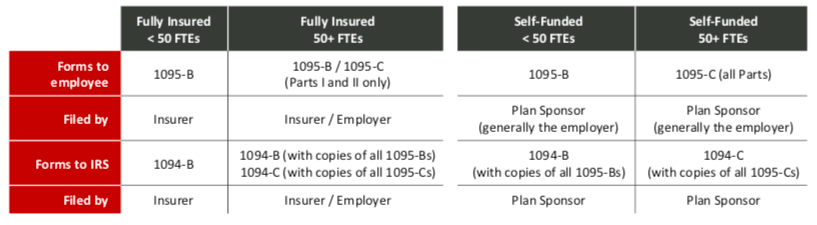

Note that substitute forms may be used, but the substitute forms must include all of the information required by Forms 1094C and 1095C and must satisfy all of the IRS's form and content requirements Forms 1094B and 1095B are to be used by a small selfinsured employer that is not an ALE for Section 6055 purposes employee a Form 1095C, and are also required to file with the government Form 1094C along with all of their FullTime employees' Form 1095Cs The Forms are required to report for all months of the calendar year Form 1094C is a transmittal form, providing information to the government regarding the employer, theThe due date for filing Forms 1094C and 1095C with the IRS is February 28th, 21 if filing by paper, and March 31st, 21 if filed electronically ACA Penalties for Late Filing (Small Businesses) The penalties range from $50$530 per missed ACA

News Leavitt Com Wp Content Uploads 15 06 109

Irs Releases Draft 19 Aca Reporting Forms And Instructions Alera Group

Employers will file copies of Forms 1095C with transmittal Form 1094C to the IRS The employer will indicate on Form 1094C if it is eligible for alternative (simplified) reporting Employers also will use this form to certify that the employer is eligible for transition relief under the ACA "play or pay" rules, if applicable Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owes a payment under the Employer Shared Responsibility Provisions under IRC Section 4980H1095C submissions and corrected IRS Form 1095C submissions – they need to be transmitted separately Our application allows you to select between Original and Corrected •It is possible to submit a corrected IRS Form 1094C without any corresponding IRS Form 1095C–for example •Total employee count was wrong for a month

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

1094 C 1095 C Software 599 1095 C Software

An IRS AIR TCC is required to file information returns 1094B, 1095B, 1094C and/or 1095C See the Account Ability Help menu for instructions on how to apply for an ACA TCC ("Application for ACA TCC Instructions") Applicable large employers (ALEs) that submitted Forms 1094C and 1095C should correct any errors as soon as possible to avoid possible penalties All ALEs are required to use these forms to report information about group health coverage, regardless of whether they "play or pay" in accordance with the Affordable Care Act's Employer Shared Responsibility provisions This information is filed on Forms 1094C and 1095C If businesses do not furnish or file this information accurately and timely, they might be subject to reporting penalties In addition, for selfinsured ALEs, the forms include reporting on individuals covered under the employer plan What happens if an ALE does not file a 1094C/1095C on time?

Aca Filing Services 6055 Reporting Form 1094 C

Accurate 1095 C Forms Reporting A Primer Integrity Data

Zenefits Help Center ACA Compliance Filing Forms 1094C and 1095C By Mail IRS Mailing Addresses for ACA Forms Filing Forms 1094C and 1095C By Mail see the IRS Instructions for Forms 1094C and 1095C page Address for Employers and Individuals with US Locations Companies or individuals whose principal business, For the filing year, Applicable Large Employers (ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically) Note Employers that are required to file 250 or more 1095C Forms must file electronically The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish for

Avoid Common Errors This Aca Reporting Season Health E Fx

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

1094B/1095B and 1094C/1095C Upload Specifications Files must be created using a piped delimited text (txt) file format XML, Zip or compressed files will NOT be accepted Files 250MB or larger must be submitted as multiple submissions Files that are 250MB or larger will be rejectedIf your organization has 50 or more fulltime employees, you'll need to submit IRS forms 1094C and 1095C this tax season in order to comply with the Employer Shared Responsibility provisions of the Affordable Care Act Each of the two forms serves a different purpose and requires you to share different types of information with the IRS1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 18 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

What Are The Form 1094 C And 1095 C Requirements For Self Insured Health Plans In

Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16 Along with Form 1095C, Form 1094C (transmittal form) is completed to report to the IRS summary information for each ALE member and to transmit Forms 1095C to the IRS Together, Forms 1094C and 1095C are used in determining whether an ALE member owes a payment under the employer shared responsibility provisions under section 4980HInst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C Employer

1094 C Irs Transmittal For 1095 C Forms For 5500 Tf5500

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Form 1094C and Form 1095C are subject to requirements to file returns electronically with the IRS This means that ALEs that file 250 or more information returns must file the returns electronically through the ACA Information Returns (AIR) program (Note that AIR is a new and separate system solely for ACA information returns However, the corresponding Form 1095C, line 16 code is "2D" (Limited NonAssessment Period), rather than "2B," (not a fulltime employee) The specific instructions for Form 1094CForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit

1095 Software Aca Software 1095 Reporting

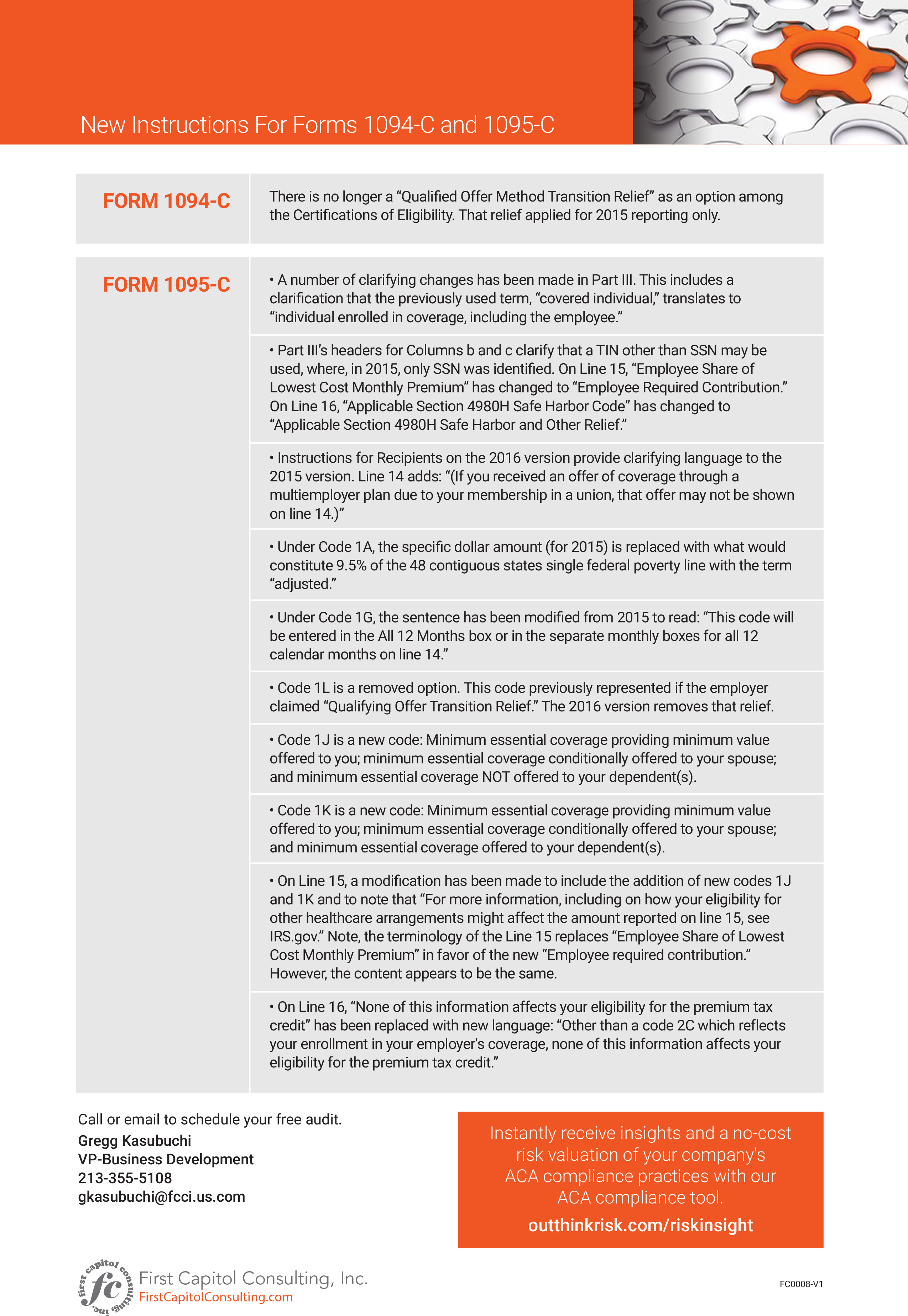

New Instructions For Forms 1094 C And 1095 C An Infographic The Aca Times

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Greenshades Guide Year End 1095 C 1094 C E File Support Center

Forms 1094 C And 1095 C Guided Tour For Employers With Self Insured Coverage Youtube

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Irs Provides Aca Reporting Relief For Compliance Guidance

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

16 Aca Reporting Forms And Instructions Revisions To Draft Forms 1094 C And 1095 C Eastern Insurance

9 Aca Affordable Care Act Software Ideas Irs Forms Tax Forms Efile

Your Complete Guide To Aca Forms 1094 C And 1095 C

Ez1095 Software How To E File 1095c And 1094c Correction Youtube

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Instructions For Forms 1094 C And 1095 C 17 Printable Pdf Download

Need To Correct An Irs 1094 C Or 1095 C Form

Irs Reporting Under The Affordable Care Act Bkd Llp

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

File Aca 1094 C 1095 C Information With Irs On Time To Avoid Penalties The Aca Times

1095 C Form Official Irs Version Discount Tax Forms

Q Tbn And9gctm28mgrcxacjysuiweiug6urts6i0vauaci8une7eonfp6ttdc Usqp Cau

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C

1094 C 1095 C Software 599 1095 C Software

Ez1095 Software How To Print Form 1095 C And 1094 C

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Irs Releases Draft Forms And Instructions For 19 Aca Reporting Michigan Benefits Agency Strategic Services Group Ssg

Affordable Care Act Form 1095 C Form And Software Hrdirect

Irs Q A About Employer Information Reporting On Form 1094 C And Form 1095 C Ca Benefit Advisors

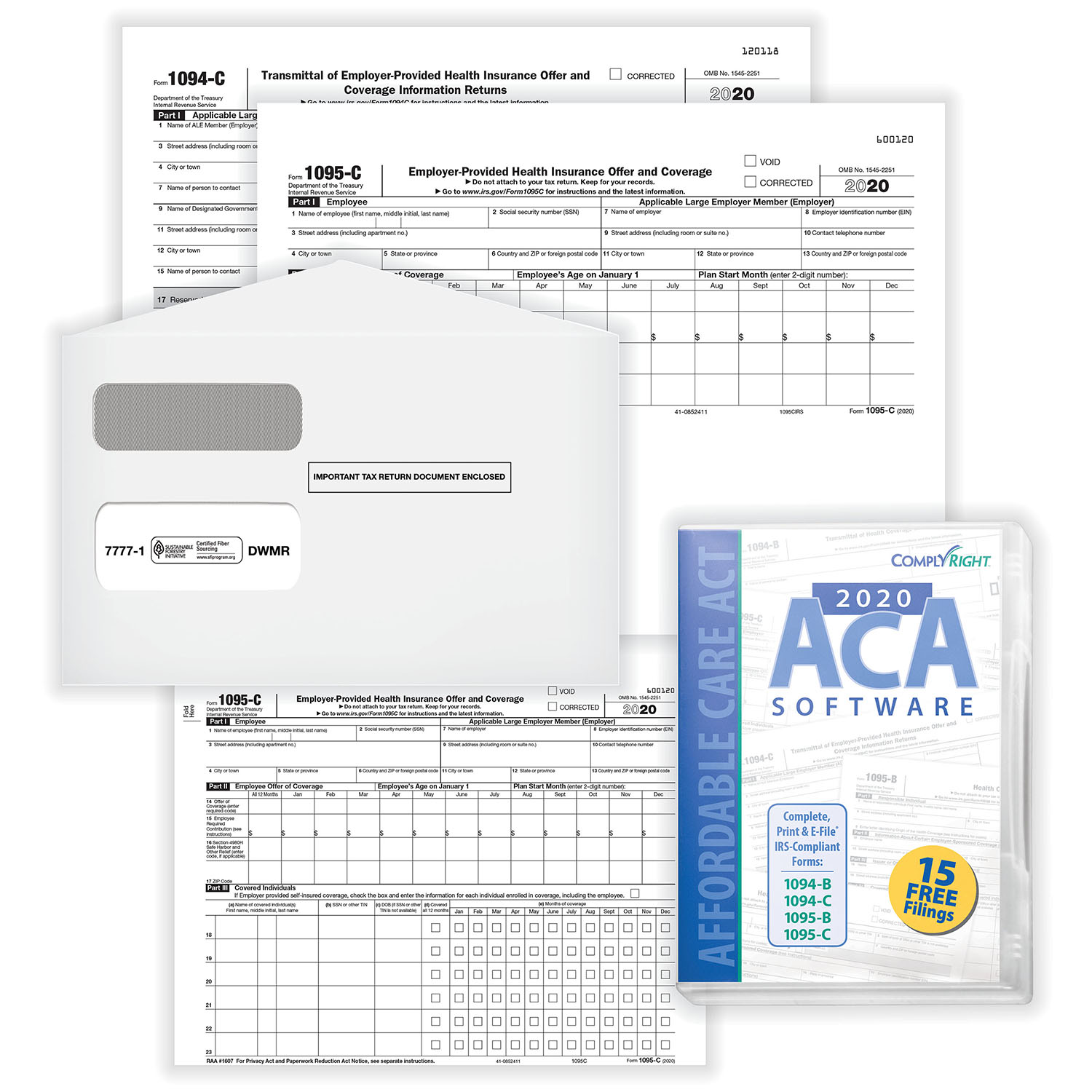

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Code Series 2 For Form 1095 C Line 16

Amazon Com Aca Tax Software Use For Forms 1095 B And 1095 C And 1094 B And 1094 C Aca Complyright Office Products

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Q Tbn And9gcs1fntfgznhwhfmy G25cencwng1g4qikx94o Xop09o3khqbve Usqp Cau

1095 C Form Official Irs Version Discount Tax Forms

17 1094c 1095 Reporting Usi Insurance Services

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

1

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

Aca Reporting 1094c 1095c

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Affordable Care Act Reporting Update Benefit Minute Psa Insurance And Financial Services

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Employer Reporting Forms 1094 C And 1095 C Hays Companies

1095 Software 1095 Printing Software 1095 Efile Software

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Irs Final Aca Compliance Forms Now Available Bernieportal

Irs Releases 1094 C 1095 C Forms For 19 Tax Year

The Scoop On The New Aca 1094 C And 1095 C Forms

1095 C Reporting Determining A Company S Ale Status Integrity Data

What Cpas Need To Know About New Ppaca Forms

Introduction To Affordable Care Act Health Coverage Returns Air

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Mailing Deadline February 28 Aca Gps

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

Aca Forms 1095 C And 1094 C To E File Or Not To E File With The Irs Integrity Data

Form 1094 C The Aca Times

Affordable Care Act Form 1095 C Hrdirect

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

1094 C And 1095 C Reporting Youtube

What You Need To Know About Forms 1094 1095

Irs Delays The Deadline To Furnish The Aca Forms 1095 C And 1095 B To March 2 17 And Extends The Good Faith Transition Relief From Reporting Penalties Trucker Huss

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Irs Issues Draft Of Updated 1094 C And 1095 C Forms For Tax Year Time Equipment Company

Draft Forms 1094 C And 1095 C Released Hylant

Free 1095 C Resource Employee Faqs Yarber Creative

15 Forms 1094 B 1095 B 1094 C And 1095 C Benefits Work

United Benefit Advisors Home News Article

Common Mistakes In Completing Forms 1094 C And 1095 C

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Brinson Benefits

Irs Finalizing 1094c 1095c Reporting Process Usi Insurance Services

Aca Compliance Filing Irs Forms 1094 C And 1095 C

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Aca 1094 C 1095 C Reporting Through Easecentral Claremont Insurance Services

0 件のコメント:

コメントを投稿